January 18, 2019

Shutdown Survey…Excise Tax Extension…Bond Requirement…New Members…Winning Wine

If you are not already a member of WineAmerica, join now!

Shutdown Affects Wineries

Need a COLA? You’re out of luck.

As the partial government shutdown enters its fifth week, wine industry members needing Certificate of Label Approvals or other help from the Tax and Trade Bureau are out of luck, since the Treasury Department, TTB’s parent agency, is one of those shut down.

As a result, last week WineAmerica conducted an online survey sent to all American wineries in order to assess the actual impact so we can share it with members of Congress and the Administration. The inability to get approved COLA’s has a ripple effect, since wineries may not sell their product without them, delaying their cash flow as well as the various taxes that federal and state governments rely on. And, of course, consumers can’t enjoy the wines.

It’s a lose-lose-lose situation.

Priority #1: Excise Tax Extension

While many government agencies are shutdown, WineAmerica staff and lobbyists have been busy working on Capitol Hill with our beverage coalition partners on getting an extension to the Craft Beverage Modernization and Tax Reform Act (CMBTRA) or, far better, making it permanent.

Otherwise, one year from now, excise taxes for wineries of all sizes will go up dramatically.

CBMTRA was one of very few bills that had strong bipartisan support, with 55 Senate and 305 House co-sponsors from both sides of the aisle–unheard of in today’s Washington. The way DC works (or sometimes doesn’t), we now have to start all over, and so we have.

The beverage coalition–including associations representing wine, beer, spirits, and cider–met last week with key members of the both chambers and secured the originating sponsors: Representatives Ron Kind (D-WI) and Mike Kelly (R-PA), and Senators Roy Blunt (R-MO) and Ron Wyden (D-OR). Senator Wyden originated the bill a couple years ago, and Senator Blunt got it inserted into the broader Tax Cuts and Jobs Act.

The next step is enlisting other co-sponsors from around the country, and we will work with our colleagues in the State and Regional Associations Advisory Council to reach out to their elected officials in Washington.

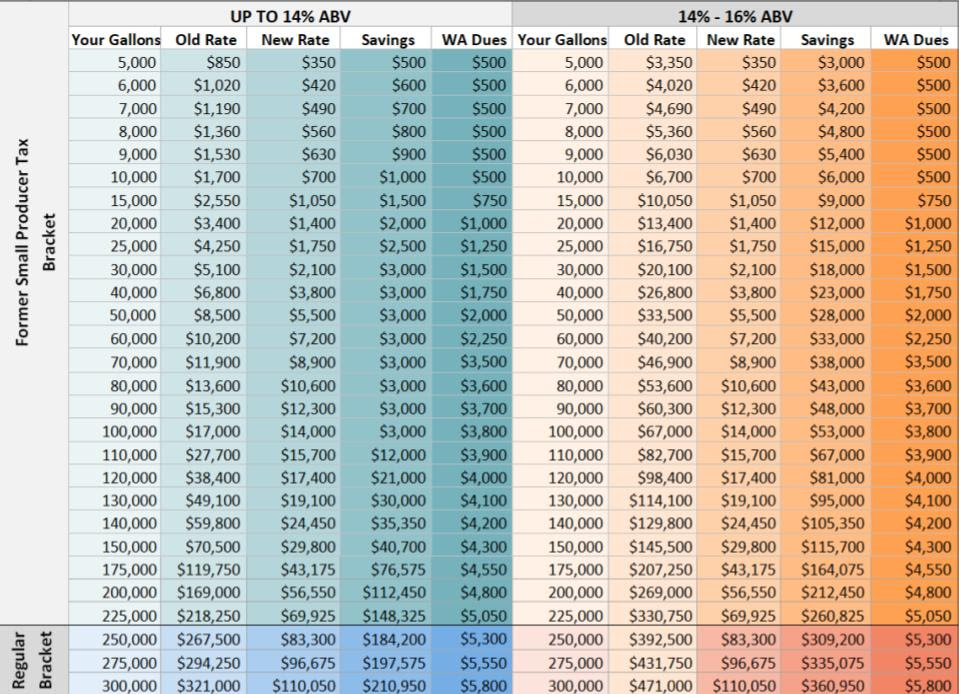

The bill includes a series of tax credits which lower the effective tax rate on various levels of production, and may be used on sparkling wines as well as table wines. In addition, for tax purposes the alcohol by volume (ABV) limit for table wines was increased from 14% to 16%.

However, the bill is also set to expire on December 31, 2019 which, if that occurred, would reverse all the benefits.See the chart below to assess how much you are saving now (and would lose if we don’t extend this).

Glitch Fix: Alas, as often happens when complex bills are rushed through Congress at midnight, technical errors occur, and this one was no exception.

The problems had to do with the application of the new tax system to custom crush facilities and bonded wine cellars, and could have had very damaging effects. Once again, WineAmerica worked closely with Wine Institute and the Napa Valley Vintners Association to start fixing the glitches, some of which have already occurred.

It is important to note that when all the glitches are fixed, the corrected system will be retroactive to January 1, 2018, so wineries will eventually be made whole.

WineAmerica Vice President Michael Kaiser is the resident expert in this area. (mkaiser@nullwineamerica.org)

We take care of your business climate so you can take care of your business.

Federal Bond?

Do you need a federal bond for your winery?

That question was addressed in WineAmerica’s “Weekly Harvest” e-newsletter for members that goes out at the beginning of each week. Next Monday’s edition will include information about the structure of the excise tax reform in the CBMTRA. Both subjects are typical of the practical, timely, helpful information members get each week.

For a limited time only, we’re sending it beyond our membership base to all wineries in the country to demonstrate WineAmerica’s value. (If you didn’t get it, contact tgood@nullwineamerica.org and ask that she send it and add you to our e-list).

Oh, about the bond requirement: The bottom line, in simplistic terms, is that wineries with less than $50,000 of excise tax liability in 2018 don’t need a federal bond, but there are also TTB reporting requirements before you can benefit from this savings. So make sure you read the newsletter carefully, and contact Michael Kaiser with any questions (mkaiser@nullwineamerica.org).

Elimination of the federal bond requirement for some wineries is just another example of the money-saving policies that WineAmerica has successfully advocated for over the years. Others include the CBMTRA, the Small Producer Tax Credit, and Repeal of the Special Occupational Tax.

As a result of all this, a 10,000-gallon winery saves over $11,000 each year–and their WineAmerica dues are only $500. Talk about a great Return on Investment!

WineAmerica: We Save You Money

Welcome New Members

Since the last edition of this newsletter, we have been pleased to welcome three new members: Marker Cellars Family Winery (TX), Lakeland Winery (NY), and Zugibe Vineyards (NY). As a New Yorker, I’m proud that my state has the most WineAmerica members of any state, but I would also love to see that change because other states boosted their support.

Secrets of Success: Prioritization, Persistence, and Partnerships form the key blend in moving legislation over the finish line. Our WineAmerica team clearly articulates the wine industry’s needs, keeps repeating that message, and joins with other groups to make it all happen.

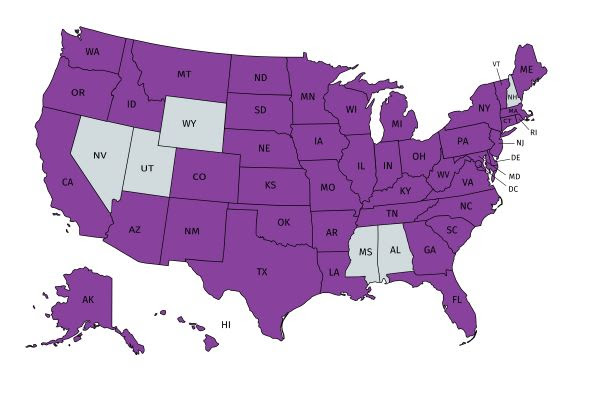

Another reason for WineAmerica’s effectiveness in the area of national grassroots public policy is the large number of winery members from 44 states–which means 88 U.S. Senate offices and hundreds in the House of Representatives. The map below shows states where our members are from (other than those shown in white which have none–though we’re working on them!)

(States in purple represent WineAmerica’s membership, and we were delighted to recently turn Alaska purple.)

If you are not already a WineAmerica member, we encourage you to join today.

Winning Wines

There was no WineAmerica Perspectives last week because I was in Cloverdale, CA judging at the San Francisco Chronicle Wine Competition, the nation’s largest with nearly 7,000 entries from all around the country. As always, it was very well run and a lot of fun to taste all kinds of wines, not to mention enjoying wonderful dinners at night.

The “Chronicle”, as we call it, is also fair, given the fact that wines from virtually everywhere and of every type are not only given serious consideration, but often win top awards. For example, of the top eight wines in various categories, five were from California (where the vast majority of entries originated), but the other three from New York, Texas, and Virginia.

Wine–The All-American Art Form!

Cheers!

Jim Trezise

President, WineAmerica

(Interested in receiving this email? Contact tgood@nullwineamerica.org)