Prepared for WineAmerica by John Dunham & Associates

September 19, 2022

Executive Summary

The 2022 Economic Impact Study of the American Wine Industry estimates the economic contributions made by the wine industry to the U.S. economy in 2022. John Dunham & Associates (JDA) conducted this research, which was funded by WineAmerica. This work used standard econometric models first developed by the U.S. Forest Service, and now maintained by IMPLAN Group, LLC. Data came from WineAmerica, additional industry sources, government publications, and Data Axle.¹

The study defines the Wine Industry as: Winegrape growing, wine production, and the wholesaling, retailing and direct to consumer sales of wine in all fifty states plus the District of Columbia. The first tier of the wine industry is comprised of vineyards which grow winegrapes and wineries which produce wine. Once the wine is produced and bottled, it is ready for the second tier of the industry – the wholesalers. Wholesalers are responsible for the transportation and the storage of wine from producers to the third tier – the retailers. The retailing tier is made up of on-premise retailers such as restaurants, bars, sport stadiums, etc., and off-premise retailers such as liquor stores, grocery stores, etc.

In addition to the three tiers of the industry, the study calculates the economic contribution to each state made through the spending of tourists visiting the nation’s 10,637 wineries.²

Associations and organizations that help develop the U.S. wine industry through education and research have also been included in this study.

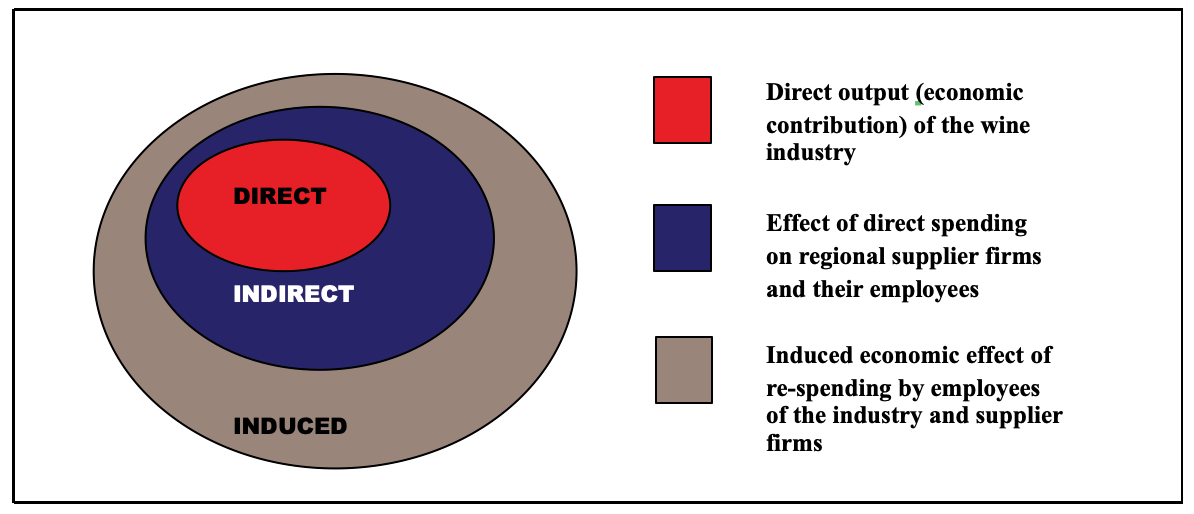

The study measures various factors of the U.S. wine industry: The number of jobs, the wages paid to employees, the value added, and total output. In addition, it assesses the economic impact of the suppliers that support the U.S. wine industry, as well as those industries supported by the induced spending of both the direct and supplier industries.

Every industry inevitably makes purchases from a mix of different sectors—thus, an economic activity within one industry always extends beyond its origins, through means such as employee spending. Economic activity started by the U.S. wine industry generates output (and jobs) in hundreds of other industries, often in states far removed from the site of the original production. The impact of supplier firms and the “induced impact” of the re-spending by employees of industry and supplier firms are calculated using an input-output model of the United States. The study calculates the impact at the national and state levels.

The study also estimates taxes paid by the industry and its employees. Federal taxes include industry-specific excise and sales taxes, business and personal income taxes, FICA, and unemployment insurance. State and local tax systems, on the other hand, vary widely. Direct retail taxes include state and local sales taxes, license fees, and applicable gross receipt taxes. Retailers pay real estate and personal property taxes, business income taxes, and other business levies that vary in each state and municipality. All entities engaged in business activity generated by the industry pay similar taxes. In addition to this, consumers pay billions of dollars in federal, state and local sales and excise taxes when they purchase wine at both on- and off-premise establishments.

The American wine industry is a dynamic part of the U.S. economy, accounting for approximately $276.07 billion in output or around 1.28 percent of GDP³. It employs about 1.84 million Americans who earn wages and benefits of about $95.50 billion.

Members of the industry and their employees pay $22.83 billion in federal, state and local business taxes. Consumption taxes, which account for state and local sales taxes as well as excise taxes that apply to specific retail services, contribute $8.15 billion to the American economy.

Summary Results

As previously mentioned, the U.S. wine industry includes wineries (manufacturers), winegrape growers, wholesalers that handle wine, as well as retail establishments, such as liquor stores, warehouse clubs and supercenters, restaurants, and concert venues. The impact of spending from visitors to wineries and vineyards as well as associations and research and educational organizations are also captured in the study. The industry reaches into all corners of the United States, employing 1,007,459 (FTE workers) and generating $40.11 billion in wages. The industry directly generates $111.55 billion in national economic activity.

Table 1

Economic Contribution of the U.S. Wine Industry

|

Direct |

Indirect |

Induced |

Total |

|

|

Jobs |

1,007,459 |

364,234 |

473,208 |

1,844,901 |

|

Wages |

$40,106,187,600 |

$26,056,752,800 |

$29,329,602,600 |

$95,492,543,000 |

|

Economic Impact |

$111,552,102,200 |

$76,257,092,400 |

$88,264,118,100 |

$276,073,312,700 |

|

Business Taxes |

$22,825,305,000 |

|||

|

Consumption Taxes |

$8,149,267,400 |

|||

The production process (as defined in this study) begins with the farming of winegrapes at vineyards. U.S. Vineyards directly employ 55,902 in the process of growing winegrapes4.

Wineries grow winegrapes in their own vineyards, or purchase winegrapes from other vineyards both in state and from major grape growing regions. Winegrapes are then turned into wine in the vinification process, which involves crushing, pressing, fermentation, blending and sometimes barrel aging. After the vinification process, the wine is bottled and ready to enter the wholesale and the retail tiers. All told, U.S. wineries and the vineyards they own directly employ 75,645 people in the state.

Once the wine has been produced and bottled, it enters the second tier of the industry – the wholesaling tier. Wholesalers are involved in the transportation of wine from the producers and the storage of products for a limited period of time. The U.S. wine industry is directly responsible for over 43,662 FTE jobs nationwide in the wholesaling sector.

The third tier of the industry directly sells products to the consumer. For this analysis, the retail tier is assumed to consist of firms in the following industries: Restaurants, hotels and taverns, wine and liquor stores, and, in states where sales are allowed, grocery, drug, convenience stores and gas stations. The wine industry is directly responsible for 675,536 jobs in the retailing sector.

Finally, the direct impact of the U.S. wine industry also includes the economic impact of wine-related tourism. All told, wine tourism is directly responsible for 155,035 jobs in the country.

Other firms are related to the wine industry as suppliers. These firms produce and sell a broad range of items including machinery, tools, parts, processing aids and other materials needed to produce winegrapes and wine, and to distribute, and sell wine in the U.S. They also provide various services, including agricultural services personnel services, financial services, advertising services, consulting services, and transportation services. Finally, a number of people are employed in government enterprises responsible for the regulation of the wine industry. All taken into account, the industry is responsible for 364,234 supplier jobs. These firms generate about $76.26 billion in economic activity.

An economic impact analysis of the wine industry also takes additional linkages into account. While it is inappropriate to claim that suppliers to the industry’s suppliers are part of the industry being analyzed5, the spending by employees of the industry, and that of supplier firms with jobs that are directly dependent on the wine industry, should be included. This spending – on everything from housing, to food, to education and medical care – makes up what is traditionally called the “induced impact,” or multiplier effect, of the wine industry. For 2022, the induced impact of the industry accounts for 473,208 jobs and $88.26 billion in economic activity, for a multiplier of 0.796.

An important part of an impact analysis is the calculation of the contribution of the industry to the public finances of the country. In the case of the wine industry, the business taxes paid by firms and their employees provide $14.67 billion to the federal government and $8.15 billion to state and local governments. In addition, the consumption of wine generated an estimated $875.28 million in federal tax revenues and $7.27 billion in state and local tax revenues. These consumption taxes include taxes such as excise taxes and sales taxes.

Table 1 presents a summary of the total economic impact of the wine industry in the United States. Summary tables for the United States and individual states are included in the output model, which is discussed in the following section.

Economic Impact Modeling – Summary

The Economic Impact Study begins with an accounting of the direct employment in the wine industry. The data come from a variety of government and private sources. It is sometimes mistakenly thought that initial spending accounts for all of the impact of an economic activity or a product. For example, at first glance it may appear that consumer expenditures for a product are the sum total of the impact on the local economy. However, a single economic activity leads to a ripple effect that benefits other sectors and industries through this initial spending. This inter-industry effect of an economic activity can be assessed using multipliers from regional input-output modeling.

The economic activities of events are linked to other industries in the state and national economies. Activities related to the wine industry represent the direct effects on the economy. Indirect (or supplier) impacts occur when these activities require purchases of goods and services such as advertising services or merchandising material from local or regional indirect firms. Additional induced impacts occur when workers involved in direct and indirect activities spend their wages. The ratio between induced output and direct output is termed the multiplier.

This method of analysis allows the impact of local production activities to be quantified in terms of final demand, earnings, and employment in the states and the nation as a whole.

Once the direct impact of the industry has been calculated, the input-output methodology discussed below is used to calculate the contribution of the indirect sector and of the re-spending in the economy by employees in the industry and its indirect firms. This induced impact is the most controversial part of economic impact studies and is often quite inflated. In the case of the WineAmerica model, only the most conservative estimate of the induced impact has been used.

Model Description and Data

This economic impact analysis was developed by JDA based on data provided by the WineAmerica, Data Axle, state government licensing bodies, the US Department of Agriculture, and other industry sources. The analysis utilizes the IMPLAN Group, LLC’s model in order to quantify the economic impact of the wine industry on the economy of the United States, as well as individual states7. The model adopts an accounting framework through which the relationships between different inputs and outputs across industries and sectors are computed. This model can show the impact of a given economic decision – such as a factory opening or operating a sports facility – on a pre-defined, geographic region. It is based on the national income accounts generated by the US Department of Commerce, Bureau of Economic Analysis (BEA)8.

Vineyards

The vineyards that supply winegrapes to the wine industry are vital to the U.S. economy. In order to estimate the economic impact of vineyards in the U.S., JDA gathered data from the United States Department of Agriculture and the Wines & Vines Winery Directory9. State average acreage per job values were used to calculate the number of winegrape bearing acres for facilities where those data were not available, and vice-versa, jobs per acre data were used to fill in missing employment numbers.

Vineyards that were part of a winery operation may be double counted since there is no data available to separate independent vineyards from vineyards which are owned and operated by a winery10.

JDA estimates that there are about 119,520 acres of farmland being used to grow winegrapes that are not owned by wineries themselves. These are winegrape growers that sell fruit to wineries around the country. In order to tend to these vineyards, an estimated 55,902 full-time equivalent jobs are needed. It is important to note that full-time equivalent jobs are not the same as number of people. FTE jobs are estimated using the value of winegrapes grown, acreage and IMPLAN.

Many of the jobs on farms are different than other occupations in that they are not the normal eight hours a day, 40 hours a week kind of activity. Even many owners of small farms operations only work part-time on agricultural activities, and a great majority of labor intensive vineyard activities (harvesting, pruning, shoot thinning and suckering) are performed by teams of seasonal workers who move from vineyard to vineyard and between agricultural sectors. These workers often only work for a few days or weeks on any given farm.

Due to the seasonal nature of vineyard work, one full-time equivalent farm job is equal to the work performed by 2.2 actual farm workers, with an average farm worker preforming about 832 hours of labor in the industry (compared with about 1800 hours for a full-time worker in a non-agricultural occupation)11.

Wineries

The economic impact of wineries is based on data from the following sources: Government licensing data, Data Axle, industry sources, and data provided by WineAmerica. Wineries are defined as: Wineries producing their own wines brands, wineries/production facilities contracted to produce wines for other companies, and companies marketing their own wine brand, but not producing the wine itself (so called virtual wineries)12.

Based on these combined datasets, it is estimated that there are about 10,637 wineries in the United States. Data-Axle employment figures are used for estimate the jobs in each facility. Where employment data is unavailable, median job figures were used. JDA estimates that there are about 75,645 jobs relating to the production or marketing of wine in the United States. These workers earn an estimated $5.27 billion and generate an estimated $27.30 billion in economic activity for the U.S. economy.

Wholesale

The wholesaling tier is responsible for the transportation of domestically produced wine from wineries, importation of wines from other countries, and for the storage of these products for a limited amount of time across the entire country. Data to identify these facilities include Alcohol Wholesaler Permit Lists from the US Department of the Treasury Alcohol and Tobacco Tax and Trade Bureau (TTB), and Data Axle and the Wine and Spirits Wholesalers of America (WSWA). JDA estimates that there are about 3,042 facilities in the United States that are responsible for the wholesaling of wine. Data Axle employment data is used to estimate the number of jobs in each facility that was associated with the distribution of wine. Where employment data is unavailable, median employment figures are used. JDA estimates that there are about 43,662 jobs in the wine wholesaling sector, earning about $3.85 billion in wages and benefits, and contributing about $14.12 billion in economic activity to the U.S. economy.

Retail

The retailing tier is comprised of both on-premise retailing and off-premise retailing. On-premise retailers allow for the consumption of wine at the facility. Examples of on-premise retailers include businesses such as restaurants, bars, and sporting venues. Off-premise retailers sell wine to take away and consume elsewhere. Examples of these types of retailers include businesses such as grocery stores, liquor stores, and warehouse clubs.

Employment data were gathered at the zip code level from Data Axle, the Economic Census of Retail Trade by Product Line13, and U.S. Department of Commerce – Bureau of Economic Analysis – Personal Consumption Expenditures by Type of Product14. These data were used determine the type of off-premise stores that sell wine as well as the percent of sales at each store type that is due to the sale of wine. IMPLAN Use data and U.S. Department of Commerce – Bureau of Economic Analysis – Personal Consumption Expenditures by Type of Product is used to determine the type of on-premise stores that sell wine as well as the percent of sales at each store type that is due to the sale of wine. JDA estimates that there about 675,536 people (FTE) employed in the U.S. that are responsible for selling wine in retail businesses. These workers earn about $22.92 billion in wages and benefits while contributing $51.09 billion in economic activity to the U.S. economy.

Associations

The wine associations sector is defined as trade associations which participate in the promotion of wine related industries such as wineries, winegrape vineyards, importers, and even suppliers. These associations serve to encourage growth and development of wine related industries through education and sound public policies

Data for wine associations were provided by WineAmerica, Wines & Vines15, and Data-Axle. Employment data for each facility is gathered from the Data-Axle database. Any employment data that is missing is estimated using median job figures. JDA estimates that wine related trade associations employ about 891 people in the U.S. These workers earn approximately $87.80 million in wages and benefits while contributing an estimated $200.09 million in economic activity to the U.S. economy.

Research and Education

The research and education sector is defined as organizations which are involved in applied research and educational programs that facilitate the development and advancement of knowledge that enable wineries, winegrape growers, and other wine-related industries to improve and protect the quality of their goods and services.

Data for wine research and educational organizations were provided by WineAmerica, Wines&Vines, and Data-Axle. Employment data for each facility is gathered from the Data-Axle database. Any employment data that is missing is estimated using median job figures. JDA estimates that research and education specialists employ about 788 people in the U.S. These workers earn approximately $91.34 million in wages and benefits while contributing an estimated $200.92 million in economic activity to the U.S. economy.

Wine Tourism

One of the important elements of the impact of wineries on the U.S. economy is their attractiveness to tourists. Every year, millions of people visit wine growing regions across the country in part to visit (or even stay at) wineries, learn about wine and sample different wines. In order to estimate the economic impact of these visits it was first necessary to calculate the number of visitors to the country’s 10,637 wineries. This was done at the county level based on an econometric model that used detailed data calculated by key wine producing counties in California as a means of estimating visitors per winery. A function was developed that estimated the number of visits per winery based on the number of wineries in each of the 1,407 counties in the United States that produce wine. This relies on the idea of economic clustering, which suggests that a larger grouping of wineries would attract more visitors to each winery than a smaller grouping. The tendency of locational clustering of similar types of firms has been documented by economists since at least the beginning of the twentieth century. British academic Stephen Brown described the rule of ‘retail compatibility,’ which explains how retail businesses, such as restaurants, know that two compatible firms in close proximity will show an increase in business volume directly proportionate to the incidence of consumer interchange between them15. This concept was confirmed by a study by Andrei Rogers who found that the clustered spatial pattern exhibited by consumer goods retailers appears to contradict a common hypothesis that these stores tend to repel one another17.

While Rogers suggests that population densities have a lot to do with the clustering, there is significant economic theory that suggests that the tendency of activities to cluster is related more to competitive characteristics than to generalized demographic characteristics18.

Using this model JDA calculates that a winery existing alone in a county would receive just under 2,050 visitors in a year, and that the number of annual visitors would rise linearly at a rate of about 10 additional visits per year for each additional winery in the county19. As such, a county with 100 wineries would see about 304,000 visits, while one with 1,000 wineries would report over 12.0 million.

Multiplying out the number of visits across all counties with wineries gives a total of over 49.1 million unique visits. Based on survey data from Napa California, each person visits on average 3.29 wineries, so dividing visits by 3.29 gives an estimate of just under 15.0 million actual wine related tourists across the country20.

Visitors were distributed across counties then aggregated by state. Adjustments were then made to account for the size of wineries in different states (California and New York, for example, tend to have larger wineries than say Illinois or Montana). Other adjustments were made to account for both state population and the number of people per square mile since the majority of people visiting wineries tend to come from the local area. The final results were compared with state wide studies of wine tourism; however, these were so varied and most did not contain detailed methodologies, so overall, these figures may not completely jibe with earlier tourist counts put out by individual states21.

Once the number of visitors was calculated, spending propensities using data as broken into 24 industries based on percentages derived from the US Department of Commerce, Bureau of Economic Analysis22. These were in turn, combined into aggregate categories for processing with the IMPLAN model. As such, rather than basing the tourism impact on jobs (as with the rest of the study), it is based on estimated visitor spending on key tourism categories.

IMPLAN

The IMPLAN Group model is designed to run based on the input of specific direct economic factors. It uses a detailed methodology (see IMPLAN Methodology section) to generate estimates of the other direct impacts, tax impacts and indirect and induced impacts based on these entries23.

Once the initial direct employment figures have been established, they are entered into a model linked to the IMPLAN database. The IMPLAN data are used to generate estimates of direct wages and output. Wages are derived from data from the U.S. Department of Labor’s ES-202 reports that are used by IMPLAN to provide annual average wage and salary establishment counts, employment counts, and payrolls at the county level. Since this data only covers payroll employees (those eligible for unemployment insurance), they are modified to add information on those who are not, such as: independent workers, agricultural employees, and construction workers. Data are then adjusted to account for counties where non-disclosure rules apply. Wage data include not only cash wages, but health and life insurance payments, retirement payments, and other non-cash compensation as well. They include all income paid to workers by employers.

Total output is the value of production by industry in a given state. It is estimated by IMPLAN from sources similar to those used by the BEA in its RIMS II series. Where no Census or government surveys are available, IMPLAN uses models such as the Bureau of Labor Statistics’ growth model to estimate the missing output.

The model also includes information on income received by the federal, state, and local governments, and produces estimates for the following taxes at the federal level: corporate income, payroll, personal income, estate and gift, excise taxes, customs duties, and fines, fees, etc. State and local tax revenues include estimates of corporate profits, property, sales, severance, estate and gift and personal income taxes as well as licenses, fees, and certain payroll taxes.

State sales and excise taxes were calculated based on total wine sales volume data from 2020(the latest available), and state and federal excise and sales tax rates as of the beginning of 202224.

IMPLAN Methodology25

Input-output analysis, for which Wassily Leontief received the 1973 Nobel Prize in Economics for, is an econometric technique used to examine the relationships within an economy. It captures all monetary market transactions for consumption in a given period and for a specific geography. The IMPLAN model uses data from many different sources – as published government data series, unpublished data, sets of relationships, ratios, or as estimates. The Minnesota IMPLAN group gathers this data, converts them into a consistent format, and estimates the missing components.

There are three different levels of data generally available in the United States: federal, state, and county. Most of the detailed data are available at the county level, but there are many issues with disclosure, especially in the case of smaller industries. IMPLAN overcomes these disclosure problems by combining a large number of datasets and estimating variables that are not found in the merged data. The data are then converted into national input-output matrices (Use, Make, By-products, Absorption, and Market Shares) as well as national tables for deflators, regional purchase coefficients, and margins.

The IMPLAN Make matrix represents the production of commodities by industry. The Bureau of Economic Analysis (BEA) Benchmark I/O Study of the US Make Table forms the bases of the IMPLAN model. The Benchmark Make Table is updated to current year prices, and rearranged into the IMPLAN sector format. The IMPLAN Use matrix is based on estimates of final demand, value-added by sector, and total industry and commodity output data as provided by government statistics or estimated by IMPLAN. The BEA Benchmark Use table is then bridged to the IMPLAN sectors. Once the re-sectoring is complete, the Use tables can be updated based on the other data and model calculations of interstate and international trade.

In the IMPLAN model, as with any input-output framework, all expenditures are in terms of producer prices. This allocates all expenditures to the industries that produce goods and services. As a result, all data not received in producer prices are converted using margins derived from the BEA Input-Output model. Margins represent the difference between producer and consumer prices. As such, the margins for any good add up to one.

Deflators, which account for relative price changes during different time periods, are derived from the Bureau of Labor Statistics (BLS) Growth Model. The 224 sector BLS model is mapped to the 546 sectors of the IMPLAN model. Where data are missing, deflators from BEA’s Survey of Current Businesses are used.

Finally, the Regional Purchase Coefficients (RPCs) – essential to the IMPLAN model – must be derived. IMPLAN is derived from a national model, which represents the “average” condition for a particular industry. Since national production functions do not necessarily represent particular regional differences, adjustments need to be made. Regional trade flows are estimated based on the Multi-Regional Input-Output Accounts, a cross-sectional database with consistent cross interstate trade flows developed in 1977. These data are updated and bridged to the 546 sector IMPLAN model.

Once the databases and matrices are created, they go through an extensive validation process. IMPLAN builds separate state and county models and evaluates them, checking to ensure that no ratios are outside of recognized bounds. The final datasets and matrices are not released until extensive testing takes place.

1- Data Axle is the leading provider of business and consumer data for the top search engines and leading in-car navigation systems in North America. Data Axle gathers data from a variety of sources, by sourcing, refining, matching, appending, filtering, and delivering the best quality data. Data-Axle verifies its data at the rate of almost 100,000 phone calls per day to ensure absolute accuracy.

2- Throughout this study, the winery count refers to the number of winery facilities. A single winery may have multiple facilities throughout the state or country. Each of these facilities is included in the winery count.

3- Gross domestic product (GDP) is the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production. GDP is also equal to the sum of personal consumption expenditures, gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment.

4- Vineyards not directly owned by wineries. Some of these jobs may be double counted in the winery impacts. Limited data available makes it difficult to estimate the impact from vineyards that are owned and operated by wineries. The impact of winery owned vineyards is already captured in the winery economic impact.

5 -These firms would more appropriately be considered as part of the supplier firm’s industries.

6- Often economic impact studies present results with very large multipliers – as high as 4 or 5. These studies invariably include the firms supplying the induced industries as part of the induced impact. John Dunham & Associates believes that this is not an appropriate definition of the induced impact and as such limits this calculation only to the effect of spending by direct and indirect employees.

7- The model uses 2020 input/output accounts.

8- The IMPLAN model is based on a series of national input-output accounts known as RIMS II. These data are developed and maintained by the U.S. Department of Commerce, Bureau of Economic Analysis as a policy and economic decision analysis tool.

9- Wines & Vines Directory/Buyers Guide 2022, Wines & Vines Analytics, Sonoma CA, 2022

10- JDA staff undertook an extensive review of vineyards; however, a vineyard may be located far from a production facility, but still owned by that winery.

11- US Department of Agriculture, 2017 Census, USDA, National Agriculture Statistics Service. Farm jobs statistics are measured differently than non-agricultural jobs as most workers are either seasonal or hourly. Many agricultural employees are seasonal workers who move from vineyard to vineyard over the planting and harvest period.

12- There are companies that are licensed as wineries for marketing purposes only. These companies might consist of just a single individual or small group of individuals who have simply developed a label and have sales agreements with restaurants or distributors. The actual wine is produced under contract with either a larger branded winery, or at a so-called custom crush facility that provides all of the labor and equipment. Both custom crush facilities and the companies that market this wine are included in this analysis as wineries.

13- 2017 Economic Census – Retail Trade: Subject Series – Product Lines: Product Lines Statistics by Industry for the U.S. and States: 2020, United States Census Bureau.

14- Table 2.4.5U Personal Consumption Expenditures by Type of Product, U.S. Department of Commerce – Bureau of Economic Analysis.

15- Wines & Vines Directory/Buyers Guide 2022, Wines & Vines Analytics, Sonoma CA, 2022

16- See: DeFranco, Laurence, William Lilley III, and John Dunham, The Case of the Transient Taxpayer: How Tax-Driven Price Differentials for Commodity Goods Can Create Improbable Markets, Business Economics, July 1998.

17- See: Rogers, Andrei, A Stochastic Analysis of the Spatial Clustering of Retail Establishments, Journal of the American Statistical Association, December 1965.

18- See: Braid, Ralph, Spatial Price Competition with Consumers on a Plane, at Intersections, and Along Main Roadways, Journal of Regional Science, Vol 33, No. 2, 1993.

19- The model had an R-squared statistic of 0.748 suggesting that a linear model was appropriate. The T-statistic on the coefficient was 2.982 meaning that the model was significant to the 10 percent level. This is a good level of significance considering the very low number of counties for which data were available.

20- See: 2014 Napa Valley Visitor Profile: Report of Findings, prepared by Destination Analysists for Visit Napa Valley, March 2015, at http://sodacanyonroad.org/docs/Napa%20Valley%202014%20Visitor%20Profile%20Study%20-%20Final%20Report%20of%20Findings.pdf. These were the only data available on visits per person that we have been able to find.

21- In addition, the COVID-19 pandemic has led to tremendous impact on the travel and tourism sector, which also effects this model.

22- U.S. Travel and Tourism Satellite Accounts, US Department of Commerce, Bureau of Economic Analysis, at: http://www.bea.gov/industry/tourism_data.htm. Industries included are: Traveler accommodations, food and beverage services, domestic passenger air transportation services, passenger rail transportation services, intercity bus services, intercity charter bus services, scenic and sightseeing transportation services, other vehicle rental and leasing, parking, highway tolls, performing arts, all other recreation and entertainment, gasoline, and shopping.

23- Other authors have questioned the validity of the IMPLAN model, particularly at the local level. There is some logic to this, as IMPLAN is a state level model, and is based on state averages. If, for example, a county contains the headquarters of a Fortune 500 company, then industry wage data would be well above the state average as the wages of the C-suite officers should be allocated to that location. That said, modeling the wages for the thousands of companies in the wine industry individually would be impossible simply because data of that type are not available. JDA bases its impact studies on micro level jobs data precisely because financial data are impossible to obtain. All of the ancillary information on wage, economic output and taxes are based on industry averages as provided by IMPLAN. All sub-state level data used in JDA studies are produced directly by JDA and do not utilize the input-output model framework.

24- Wine consumption in the U.S. in 2020, by state (in 1,000 gallons), National Institute on Alcohol Abuse and Alcoholism, April 2022, at: https://pubs.niaaa.nih.gov/publications/surveillance119/surveillance-report119.pdf. The more reliable data from the Alcohol and Tobacco Tax and Trade Bureau (TTB), are not presently available.

25- This section is paraphrased from IMPLAN Professional: Users Guide, Analysis Guide, Data Guide, Version 2.0, MIG, Inc., June 2000.